8 Easy Facts About Estate Planning Attorney Shown

Wiki Article

The 7-Second Trick For Estate Planning Attorney

Table of ContentsExcitement About Estate Planning AttorneyFacts About Estate Planning Attorney UncoveredThe Main Principles Of Estate Planning Attorney Excitement About Estate Planning Attorney

Your lawyer will certainly additionally aid you make your papers authorities, scheduling witnesses and notary public signatures as required, so you don't have to stress over attempting to do that last action on your very own - Estate Planning Attorney. Last, but not the very least, there is beneficial tranquility of mind in establishing a relationship with an estate planning attorney that can be there for you down the roadwayMerely placed, estate preparation lawyers offer worth in numerous ways, much past simply supplying you with printed wills, trust funds, or various other estate preparing files. If you have inquiries regarding the process and intend to find out more, call our workplace today.

An estate preparation lawyer aids you define end-of-life choices and legal papers. They can establish wills, establish trust funds, create health and wellness treatment instructions, develop power of attorney, create succession strategies, and much more, according to your dreams. Dealing with an estate preparation attorney to finish and supervise this legal paperwork can assist you in the adhering to 8 locations: Estate preparing attorneys are experts in your state's count on, probate, and tax obligation regulations.

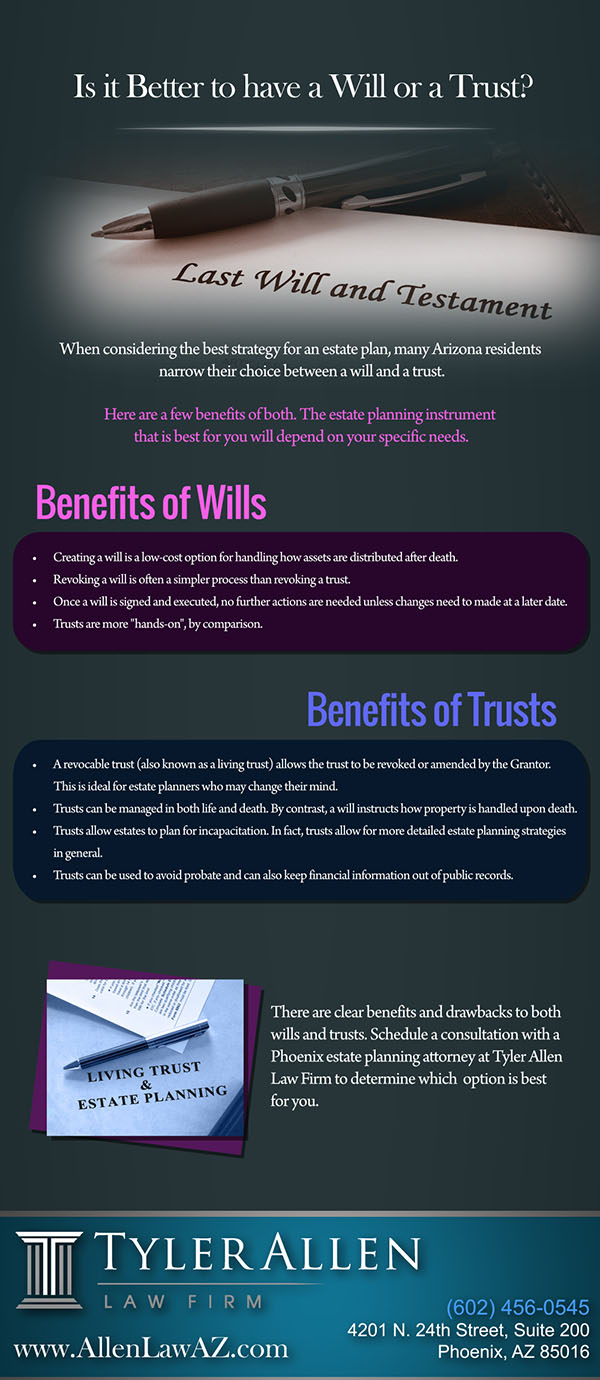

If you do not have a will, the state can determine just how to split your possessions among your heirs, which may not be according to your dreams. An estate preparation lawyer can help arrange all your legal papers and distribute your assets as you want, potentially staying clear of probate.

A Biased View of Estate Planning Attorney

Once a client passes away, an estate strategy would certainly dictate the dispersal of properties per the deceased's directions. Estate Planning Attorney. Without an estate plan, these choices may be left to the next of kin or the state. Duties of estate coordinators consist of: Developing a last will and testimony Establishing up trust accounts Calling an executor and power of attorneys Recognizing all recipients Calling a guardian for small youngsters Paying all financial obligations and minimizing all tax obligations and lawful charges Crafting guidelines for passing your worths Developing choices for funeral arrangements Settling directions for treatment if you come to be unwell and are unable to choose Obtaining life insurance policy, impairment earnings insurance, and long-term care insurance coverage A great estate plan need to be updated routinely as customers' financial situations, individual inspirations, and government and state legislations all developAs with any kind of profession, there are attributes and skills that can aid you achieve these goals as you work with your customers in an estate organizer duty. An estate planning career can be best for you if you possess the following qualities: Being an estate organizer means thinking in the lengthy term.

Unknown Facts About Estate Planning Attorney

You should aid your client anticipate his or her end of life and what will happen postmortem, while at the very same time not dwelling on dark ideas or emotions. Some customers may come to be visit bitter or you can look here anxious when considering death and it can drop to you to help them through it.In case of fatality, you might be expected to have many discussions and transactions with enduring family participants regarding the estate strategy. In order to excel as an estate coordinator, you may require to stroll a fine line of being a shoulder to lean on and the individual counted on to communicate estate planning issues in a prompt and professional way.

Expect that it has been changed even more considering that then. Depending on your customer's financial earnings brace, which might progress toward end-of-life, you as an Recommended Site estate organizer will have to keep your client's possessions in complete lawful conformity with any kind of neighborhood, federal, or global tax obligation regulations.

The 3-Minute Rule for Estate Planning Attorney

Gaining this qualification from organizations like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. Belonging to these professional teams can confirm your abilities, making you extra appealing in the eyes of a potential customer. Along with the psychological reward of aiding clients with end-of-life preparation, estate planners appreciate the advantages of a stable revenue.

Estate preparation is a smart thing to do regardless of your present health and wellness and economic standing. The initial vital point is to employ an estate planning lawyer to aid you with it.

A seasoned attorney understands what info to consist of in the will, including your recipients and unique factors to consider. It additionally offers the swiftest and most efficient technique to transfer your possessions to your beneficiaries.

Report this wiki page